E-onboarding Enhancement

Module: Onboarding

User: Candidate & HR

Platform: Mobile (iOS & Android)

Problems being addressed

Problems Faced by Candidates [Who have accepted the offer]:

- Data Entry Errors: Mistakes in personal details can delay onboarding.

- KYC Verification Issues: Mismatched details may cause verification failures.

Problems Faced by HR Professionals:

- Increased Workload: Manual review of discrepancies

- Delayed Onboarding: Errors cause delays in the hiring process.

- Error Resolution: Time-consuming communication to correct candidate data.

- System Dependency: KYC system issues can stall processing.

- Data Integrity Concerns: Incorrect submissions affect record accuracy.

How are problems getting resolved?

- User-friendly mobile UI

- Direct KYC verification

- Customizable onboarding forms

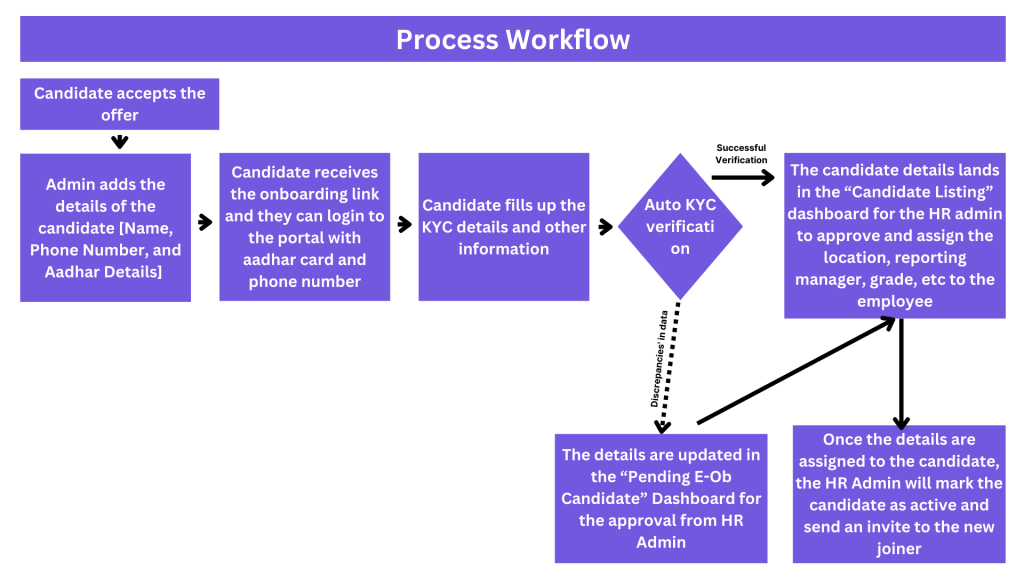

Process Workflow

How does it look in our product?

For Candidates

Once the candidates accept the offer, they receive an email from the HR Admin to download the app and start with their e-onboarding process

The candidates then have to download the app and log in to the portal using their Aadhar card and phone number details.

Once the candidate has logged into the portal, they must submit all the necessary information/documents for HR verification. These onboarding forms are highly customizable and the HR admins can customize the forms based on their organization’s requirements.

Candidates can save these form responses as drafts before making the final submission to HR.

Once the candidates have submitted the form, they get a summary of what has been uploaded and what is pending from their end ensuring that the candidate is aware of what they have submitted for the onboarding.

Once the candidates have filled out and submitted their details on the portal, they are displayed in the “Onboarding Module” dashboard so the HR admin can take the next steps.

For HR Professionals

There are chances that some candidates’ information may not be verified automatically due to some discrepancies and such candidate information is stored in the “Pending E-OB Approval” dashboard.

From here the HR admins can approve the candidate’s information after due diligence.

For the verified candidates, the details land in the “Candidate Listing” Dashboard.

The HR admin can then approve the candidates and assign them their location, reporting manager, grade, designation, etc.

Once the candidate is assigned all the necessary details, the HR admin can then mark that employee as active by going to the “Organisation Module” and updating their status as active.

This concludes a successful onboarding!

Organogram Search Functionality

Module: Core HR

Users: Managers & Employees

Platform: Web Only

Overview:

The new Organogram Search feature introduces an intuitive way for managers and employees to easily explore and visualize the organizational hierarchy. This functionality allows users to search for any employee quickly and instantly view their position within the company’s structure.

Key Features:

- Quick Search: Effortlessly find any employee by simply entering their name, department, or job title.

- Detailed Hierarchy View: Upon selecting an employee, users can see the individual’s place in the hierarchy, including their manager, direct reports, and peers.

- Interactive Visualization: The organogram is presented in a user-friendly, graphical interface that allows users to explore the hierarchy by clicking on different nodes to reveal more details.

- Cross-Department Visibility: Managers and employees can view the structure across departments, offering a comprehensive understanding of how teams and leadership are connected.

- Seamless Navigation: Users can easily navigate up and down the hierarchy tree to get a full view of the organization or zoom in on specific teams.

How It Enhances the User Experience:

- Managers can use the organogram to assess team structures, identify reporting lines, and make informed decisions regarding resource management.

- Employees can gain clarity on their reporting structure, better understand company dynamics, and even use it for career planning.

This new search functionality seamlessly integrates with the Core HR module, offering a visual, easy-to-use tool that enhances organizational transparency and employee engagement.

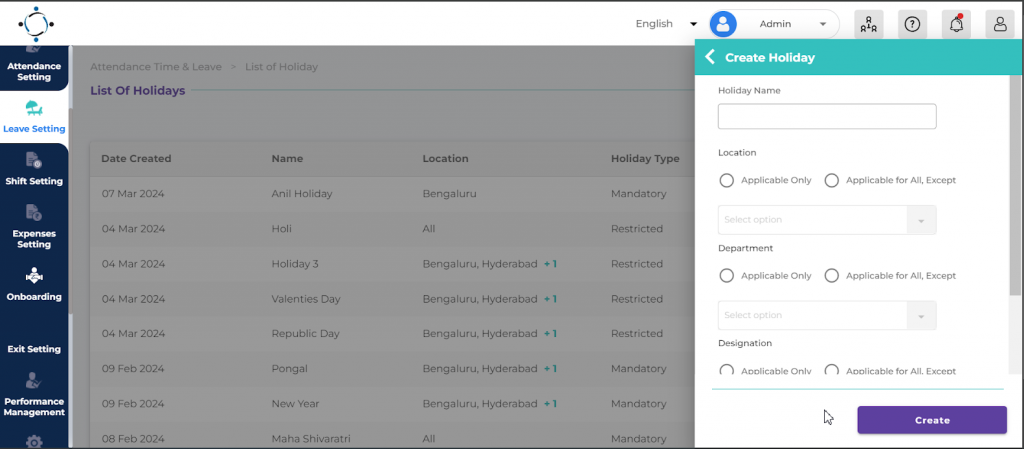

Location-Wise Holiday List

Module: Leave

User: Admin

Platform: Web Only

Overview:

The Location-Wise Holiday List feature empowers admins to create and manage holiday schedules that are specific to each office location, ensuring that holiday calendars are accurately aligned with local regulations and practices. This functionality ensures greater flexibility and accuracy when managing leave and attendance across diverse geographical locations.

Key Features:

- Location-Based Holiday Creation: Admins can easily define holidays specific to each location, allowing for differentiation between national, regional, and local holidays.

- Customizable Holiday Lists: Tailor holiday lists for multiple offices, branches, or locations based on region-specific requirements or practices.

- Accurate Leave Reflection: Employees in different locations will automatically see the correct holiday list, ensuring consistency in leave and attendance management.

- Bulk Import and Updates: Admins can upload or modify holiday lists for multiple locations at once, saving time and effort.

- Seamless Integration with Leave Management: The location-specific holidays are integrated into the leave management system, ensuring that leave balances and accruals are calculated accurately based on the holidays of each location.

How It Enhances the User Experience:

- Admins can efficiently manage holiday lists for global teams, ensuring compliance with local regulations and reducing errors in leave calculations.

- Employees benefit from clear and accurate holiday schedules that reflect the holidays applicable to their location, avoiding confusion and ensuring smoother leave planning.

This feature adds precision to the Leave module by recognizing the unique holiday requirements of different locations, promoting operational efficiency and accurate leave management across the organization.

How does it look in our product?

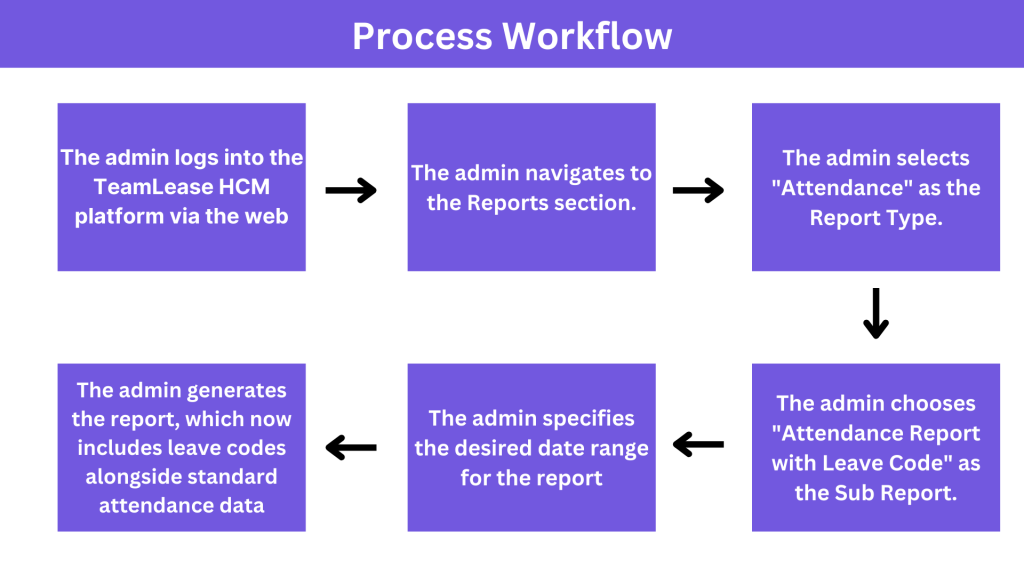

Attendance Report with Leave Code (Web Only)

Feature Type: Enhancement

Module: Report

Availability: Web Only

User: Admin Persona

Overview:

The new “Attendance Report with Leave Code” feature is an enhancement to the Reporting module, specifically designed to provide administrators with a more comprehensive view of employee attendance, including leave codes. This report is available exclusively on the web platform and is tailored to meet the needs of administrative users.

Problems Addressed:

This enhancement addresses several key challenges faced by administrators in managing employee attendance records:

- Consolidated View: Administrators often struggle with cross-referencing attendance data and leave records. This feature combines both, providing a unified report that includes leave codes alongside attendance data, simplifying the review process.

- Improved Accuracy: Manual tracking of leave alongside attendance can lead to errors and discrepancies. Integrating leave codes directly into the attendance report, feature reduces the risk of errors and ensures more accurate record-keeping.

- Time Efficiency: Administrators can now generate a detailed attendance report with leave codes in a single process, saving time and reducing the need for multiple reports or manual data merging.

Process Flow:

This enhancement streamlines the reporting process for administrators, providing a more detailed and accurate overview of employee attendance and leave, ultimately supporting better decision-making and record management.

Shift Roster Management (Web Only)

Module: Attendance and Leave

Platform: Web Only

Overview: Admins can now create multiple shift patterns and rosters, enabling the assignment of rotational shifts for employees in bulk via the UI.

Pain Points Addressed:

- Manual and error-prone shift scheduling

- Inefficient management of rotational shifts

- Lack of flexibility in shift assignment

With our new Shift Roster Management feature, admins can now:

- Create multiple shift patterns and rosters to suit varying employee schedules.

- Assign rotational shifts in bulk, reducing manual errors and inefficiencies.

- Easily set default shifts and manage rotational week-offs with just a few clicks.

- Provide employees with flexi-time for punch-in/out, offering more flexibility.

- Assign shifts to selected employees or in bulk, giving you more control and saving valuable time.

State-Wise Subtotals for PT & LWF

Problem statement:

The current statutory reports lack state-wise subtotals for Professional Tax (PT) and Labour Welfare Fund (LWF), making it difficult for organizations to reconcile these deductions by state. This results in manual calculations, increased error risks, and potential compliance issues.

Solution:

The statutory reports have been enhanced to include state-wise subtotals for PT and LWF. This update provides clear summaries for these deductions, improving accuracy and compliance with state regulations.

Key features include:

- State-wise Subtotals: Automatically generated subtotals for PT and LWF, simplifying state-level reporting.

- User-friendly Layout: Subtotals are displayed in a clear format within the existing report structure.

- Compliance & Accuracy: Reduces errors and ensures accurate reporting for state filings.

- Time Savings: Eliminates the need for manual calculations, enhancing efficiency.

How does it look

How does it help the clients?

- Improved Compliance: Ensures accurate statutory filings, reducing the risk of penalties.

- Increased Efficiency: Automates state-wise subtotal calculations, saving time.

- Enhanced Accuracy: Minimizes errors in reporting PT and LWF deductions.

HRA Exemption Validation by Month

Previously, employees could declare their HRA for the full year, but sometimes rent receipts were submitted only for certain months. To align HRA exemptions with actual rent paid, we have introduced an automated monthly validation process.

How It Works

The system will now grant HRA exemptions only for months where valid rent receipts are submitted, ensuring compliance with statutory requirements.

Example Scenario:

- Employee Name: Mr. X

- Employee ID: 12345

- HRA Declared: ₹12,000/month

Rent Payment Proofs Submitted:

Summary:

- Total HRA Declared: ₹144,000

- Total HRA Exemption Granted: ₹108,000 (for 9 valid months)

How is HRA Exemption Calculated?

For each month, the system will evaluate the HRA exemption based on the following factors:

- Rent Paid minus 10% of Basic Salary

- For Metro Cities: 40% of HRA declared

- For Non-Metro Cities: 50% of HRA declared

- General HRA Calculation Rules

The exemption will be the lowest value among these conditions, calculated month by month. This update ensures that HRA exemptions are only applied for months where actual rent has been paid and receipts have been submitted, maintaining transparency and compliance with statutory guidelines.

Payroll Cut-off Date for Salary Revisions

We have introduced a cut-off date for each payroll cycle to eliminate confusion and ensure consistency. This update will help determine when mid-cycle changes, such as salary revisions and payments for new joiners, should be included in the current payroll or treated as arrears.

How It Works

Going forward:

- Changes made before the payroll cut-off date: Will be processed in the current payroll cycle.

- Changes made after the cut-off date: Will be treated as arrears and included in the next payroll cycle.

This enhancement ensures:

- Accurate and timely payroll processing: Mid-cycle revisions are clearly defined, reducing confusion.

- Fewer errors and discrepancies: By setting a clear cut-off, we reduce inconsistencies and manual corrections.

- Compliance with payroll guidelines: Ensuring that payroll processing follows regulatory requirements and internal policies.

Benefits:

- Clear visibility on salary revisions: You’ll know exactly when changes will be reflected in your payroll.

- Simplified payroll management: Timely updates, fewer errors, and seamless handling of mid-cycle changes.

Enhancements for Budget 2024-25: Changes in Income Tax Calculation (New Tax Regime Only)

The Union Budget for the financial year 2024-25 introduced several key changes under the New Tax Regime that impact income tax calculations, especially for salaried individuals. The changes are aimed at making the new regime more attractive and beneficial for taxpayers. Here’s an overview of the major updates and how they impact tax calculations:

1. Standard Deduction Increase:

Under the new regime, the standard deduction for salaried individuals has been increased from ₹50,000 to ₹75,000. This provides higher relief to salaried individuals by reducing their taxable income.

2. Revised Income Tax Slabs:

The income tax slab rates under the new regime have also been revised. Below is the updated tax structure for the financial year 2024-25:

| Income Tax Slabs | Tax Rate |

| ₹0-3 lakh | Nil |

| ₹3-7 lakh | 5% |

| ₹7-10 lakh | 10% |

| ₹10-12 lakh | 15% |

| ₹12-15 lakh | 20% |

| Above ₹15 lakh | 30% |

These changes aim to simplify the tax calculation process while offering progressive tax benefits for different income groups.

Marginal Relief Under the New Tax Regime:

Marginal relief is provided to taxpayers to ensure that the tax payable does not exceed the incremental income above the slab threshold. This relief is designed to prevent any sudden and disproportionate increase in tax liability due to crossing a slab threshold by a small amount.

Below is a detailed illustration of how Marginal Relief applies under the new tax regime for different salary amounts:

| Gross Salary | Standard Deduction | Taxable Income (After Deduction) | Tax Liability (As Per Slabs) | Actual Tax Liability | Marginal Relief |

| ₹7,75,000 | ₹75,000 | ₹7,00,000 | ₹20,000 | ₹0 | ₹20,000 |

| ₹7,80,000 | ₹75,000 | ₹7,05,000 | ₹20,500 | ₹5,000 | ₹15,500 |

| ₹7,90,000 | ₹75,000 | ₹7,15,000 | ₹21,500 | ₹15,000 | ₹6,500 |

| ₹7,95,000 | ₹75,000 | ₹7,20,000 | ₹22,000 | ₹20,000 | ₹2,000 |

| ₹7,97,221 | ₹75,000 | ₹7,22,221 | ₹20,000 | ₹22,221 | ₹0 |

Explanation of Marginal Relief:

- Gross Salary: This is the total income before any deductions.

- Standard Deduction: The fixed deduction amount of ₹75,000 per the new regime.

- Taxable Income (After Deduction): The income left after subtracting the standard deduction from the gross salary.

- Tax Liability (As Per Slabs): The tax amount is based on the revised tax slabs for the taxable income.

- Actual Tax Liability: The actual tax payable by the taxpayer without applying for marginal relief.

- Marginal Relief: The difference between the tax liability as per slabs and the actual tax liability, ensuring that the tax burden does not increase drastically with a marginal increase in salary.

Updates to the Product:

The changes introduced by Budget 2024-25, including the revised standard deduction and new tax slabs, should be reflected in the Investment Declaration Simulator and Income Tax Calculation tools. These updates will enable employees and taxpayers to simulate their tax liabilities accurately based on the latest tax rules.

These changes make the new tax regime more beneficial for a larger section of taxpayers and aim to simplify the overall tax process.

FBP declaration report

Key Highlights

- Comprehensive Monthly Reports: You can now download detailed monthly reports of all declared FBPs.

- Status Tracking: The reports will include the status of each claim, whether Approved or Rejected, allowing for better tracking and record-keeping.

- Easy Access: Simply navigate to the “Claimed FBP” section to access and download the reports with the latest status updates.

Actual Report

This feature aims to streamline the process of managing and tracking your FBP claims, providing transparency and efficiency for both claimants and approvers.

Error log files for salary revision update

Problem Statement:

Updating employee salaries during revisions can lead to errors from missing data, incorrect inputs, or system constraints. If untracked, these errors can disrupt the payroll process and cause inaccuracies in compensation.

Solution:

Introduced an error logging feature in the payroll system to enhance validation and stability. Errors during salary revisions will be recorded in a log file, which the system will automatically email to the user for prompt tracking and resolution.

Steps to Follow:

- Go to the platform screen.

- Upload the salary register.

- The system will automatically generate an email to the user with the error log file attached, detailing any issues encountered during the salary revision process.

To provide feedback on all the above features and enhancements, reach out to us here: https://forms.gle/1Wyhz8dYEYHNbCDw9